About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 1191 results for "Lee-Ann Sutherland" clear search

Agent-based tax evasion model for investigating impacts of public disclosure

Hiroyuki Sano | Published Thursday, March 14, 2024The model explores the impact of public disclosure on tax compliance among diverse agents, including individual taxpayers and a tax authority. It incorporates heterogeneous preferences and income endowments among taxpayers, captured through a utility function that considers psychic costs subtracted from expected pecuniary utility. These costs include moral, reciprocity, and stigma costs associated with norm violations, leading to variations in taxpayers’ risk attitudes and related parameters. The tax authority’s attributes, such as the frequency of random audits, penalty rate, and the choice between partial or full disclosure, remain fixed throughout the simulation. Income endowments and preference parameters are randomly assigned to taxpayers at the outset.

Taxpayers maximize their expected utility by reporting income, taking into account tax, penalty, and audit rates. They make annual decisions based on their own and their peers’ behaviors from the previous year. Taxpayers indirectly interact at the societal level through public disclosure conducted by the tax authority, exchanging tax information among peers. Each period in the simulation collects data on total reported income, average compliance rates per income group, distribution of compliance rates, counts of compliers, full evaders, partial evaders, and the numbers of taxpayers experiencing guilt and anger. The model evaluates whether public disclosure positively or negatively impacts compliance rates and quantifies this impact based on aggregated individual reporting behaviors.

Spatial model of the noisy Prisoner's Dilemma with reward shift

Matus Halas | Published Thursday, March 05, 2015 | Last modified Tuesday, May 29, 2018Interactions of players embedded in a closed square lattice are determined by distance and overall gains and they lead to shifts of reward payoff between temptation and punishment. A new winner balancing against threats is ultimately discovered.

Peer reviewed Lethal Geometry

Kristin Crouse | Published Friday, February 21, 2020 | Last modified Wednesday, December 15, 2021LethalGeometry was developed to examine whether territory size influences the mortality risk for individuals within that territory. For animals who live in territoral groups and are lethally aggressive, we can expect that most aggression occurs along the periphery (or border) between two adjacent territories. For territories that are relatively large, the periphery makes up a proportionately small amount of the of the total territory size, suggesting that individuals in these territories might be less likely to die from these territorial skirmishes. LethalGeometry examines this geometric relationship between territory size and mortality risk under realistic assumptions of variable territory size and shape, variable border width, and stochastic interactions and movement.

The individuals (agents) are programmed to walk randomly about their environment, search for and eat food to obtain energy, reproduce if they can, and act aggressively toward individuals of other groups. During each simulation step, individuals analyze their environment and internal state to determine which actions to take. The actions available to individuals include moving, fighting, and giving birth.

Feedback Loop Example: Forest Resource Transport

James Millington | Published Friday, December 21, 2012 | Last modified Saturday, April 27, 2013This model illustrates a positive ‘transport’ feedback loop in which lines with different resistance to flows of material result in variation in rates of change in linked entities.

Musical Chairs

Andreas Angourakis | Published Wednesday, February 03, 2016 | Last modified Friday, March 11, 2016This Agent-Based model intends to explore the conditions for the emergence and change of land use patterns in Central Asian oases and similar contexts.

Wildlife-Human Interactions in Shared Landscapes (WHISL)

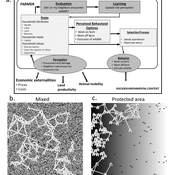

Nicholas Magliocca Neil Carter Andres Baeza-Castro | Published Friday, May 22, 2020This model simulates a group of farmers that have encounters with individuals of a wildlife population. Each farmer owns a set of cells that represent their farm. Each farmer must decide what cells inside their farm will be used to produce an agricultural good that is self in an external market at a given price. The farmer must decide to protect the farm from potential encounters with individuals of the wildlife population. This decision in the model is called “fencing”. Each time that a cell is fenced, the chances of a wildlife individual to move to that cell is reduced. Each encounter reduces the productive outcome obtained of the affected cell. Farmers, therefore, can reduce the risk of encounters by exclusion. The decision of excluding wildlife is made considering the perception of risk of encounters. In the model, the perception of risk is subjective, as it depends on past encounters and on the perception of risk from other farmers in the community. The community of farmers passes information about this risk perception through a social network. The user (observer) of the model can control the importance of the social network on the individual perception of risk.

Peer reviewed lgm_ecodynamics

Colin Wren | Published Monday, April 22, 2019This is a modification of a model published previous by Barton and Riel-Salvatore (2012). In this model, we simulate six regional populations within Last Glacial Maximum western Europe. Agents interact through reproduction and genetic markers attached to each of six regions mix through subsequent generations as a way to track population dynamics, mobility, and gene flow. In addition, the landscape is heterogeneous and affects agent mobility and, under certain scenarios, their odds of survival.

Peer reviewed Collectivities

Nigel Gilbert | Published Tuesday, April 09, 2019 | Last modified Thursday, August 22, 2019The model that simulates the dynamic creation and maintenance of knowledge-based formations such as communities of scientists, fashion movements, and subcultures. The model’s environment is a spatial one, representing not geographical space, but a “knowledge space” in which each point is a different collection of knowledge elements. Agents moving through this space represent people’s differing and changing knowledge and beliefs. The agents have only very simple behaviors: If they are “lonely,” that is, far from a local concentration of agents, they move toward the crowd; if they are crowded, they move away.

Running the model shows that the initial uniform random distribution of agents separates into “clumps,” in which some agents are central and others are distributed around them. The central agents are crowded, and so move. In doing so, they shift the centroid of the clump slightly and may make other agents either crowded or lonely, and they too will move. Thus, the clump of agents, although remaining together for long durations (as measured in time steps), drifts across the view. Lonely agents move toward the clump, sometimes joining it and sometimes continuing to trail behind it. The clumps never merge.

The model is written in NetLogo (v6). It is used as a demonstration of agent-based modelling in Gilbert, N. (2008) Agent-Based Models (Quantitative Applications in the Social Sciences). Sage Publications, Inc. and described in detail in Gilbert, N. (2007) “A generic model of collectivities,” Cybernetics and Systems. European Meeting on Cybernetic Science and Systems Research, 38(7), pp. 695–706.

ABM for Underwater optical wireless communication in a water tank

Mohamed ABID | Published Sunday, May 29, 2022This model simulates the propagation of photons in a water tank. A source of light emits an impulse of photons with equal energy represented by yellow dots. These photons are then scattered by water particles before possibly reaching the photo-detector represented by a gray line. Different types of water are considered. For each one of them we calculate the total received energy.

The water tank is represented by a blue rectangle with fixed dimensions. It’s exposed to the air interface and has totally absorbent barriers. Four types of water are supported. Each one is characterized by its absorption and scattering coefficients.

At the source, the photons are generated uniformly with a random direction within the beamwidth. Each photon travels a random distance drawn from a distribution depending on the water characteristics before encountering a water particle.

Based on the updated position of the photon, three situations may occur:

-The photon hits the barrier of the tank on its trajectory. In this case it’s considered as lost since the barriers are assumed totally absorbent.

…

A Model to Unravel the Complexity of Rural Food Security

Stefano Balbi Samantha Dobbie | Published Monday, August 22, 2016 | Last modified Sunday, December 02, 2018An ABM to simulate the behaviour of households within a village and observe the emerging properties of the system in terms of food security. The model quantifies food availability, access, utilisation and stability.

Displaying 10 of 1191 results for "Lee-Ann Sutherland" clear search