About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 1185 results for "Ian M Hamilton" clear search

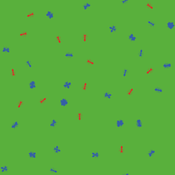

Wolf-sheep predation Netlogo model, extended, with foresight

Guido Fioretti Andrea Policarpi | Published Wednesday, September 16, 2020 | Last modified Tuesday, April 13, 2021This model is an extension of the Netlogo Wolf-sheep predation model by U.Wilensky (1997). This extended model studies several different behavioural mechanisms that wolves and sheep could adopt in order to enhance their survivability, and their overall impact on global equilibrium of the system.

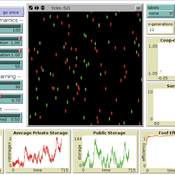

“Food for all” (FFD)

Andreas Angourakis José Manuel Galán Andrea L Balbo José Santos | Published Friday, April 25, 2014 | Last modified Monday, April 08, 2019“Food for all” (FFD) is an agent-based model designed to study the evolution of cooperation for food storage. Households face the social dilemma of whether to store food in a corporate stock or to keep it in a private stock.

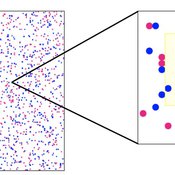

Human mate choice is a complex system

Paul Smaldino Jeffrey C Schank | Published Friday, February 08, 2013 | Last modified Saturday, April 27, 2013A general model of human mate choice in which agents are localized in space, interact with close neighbors, and tend to range either near or far. At the individual level, our model uses two oft-used but incompletely understood decision rules: one based on preferences for similar partners, the other for maximally attractive partners.

ForagerNet3_Demography: A Non-Spatial Model of Hunter-Gatherer Demography

Andrew White | Published Thursday, October 17, 2013 | Last modified Thursday, October 17, 2013ForagerNet3_Demography is a non-spatial ABM for exploring hunter-gatherer demography. Key methods represent birth, death, and marriage. The dependency ratio is an imporant variable in many economic decisions embedded in the methods.

Population Control

David Shanafelt | Published Monday, December 13, 2010 | Last modified Saturday, April 27, 2013This model looks at the effects of a “control” on agent populations. Much like farmers spraying pesticides/herbicides to manage pest populations, the user sets a control management regiment to be use

Sugarscape with spice

Marco Janssen | Published Tuesday, January 14, 2020 | Last modified Friday, September 18, 2020This is a variation of the Sugarspace model of Axtell and Epstein (1996) with spice and trade of sugar and spice. The model is not an exact replication since we have a somewhat simpler landscape of sugar and spice resources included, as well as a simple reproduction rule where agents with a certain accumulated wealth derive an offspring (if a nearby empty patch is available).

The model is discussed in Introduction to Agent-Based Modeling by Marco Janssen. For more information see https://intro2abm.com/

Memetic Exploration of Demand

rolanmd | Published Monday, August 09, 2010 | Last modified Saturday, April 27, 2013In this presentation, we use the concept of meme to explore evolution of demand.

Foundress dilemma model

Marco Janssen Takao Sasaki Zachary Joseph Shaffer Stephen Pratt Brian Haney Jennifer Fewell | Published Thursday, July 28, 2016A haystack-style model of group selection to capture the essential features of colony foundation for queens of the ant based on observation of the ant Pogonomyrmex californicus.

Agent-based model for the socio-economic monitoring of visitor streams

Stefan Mohr | Published Saturday, January 20, 2018Due to the large extent of the Harz National Park, an accurate measurement of visitor numbers and their spatiotemporal distribution is not feasible. This model demonstrates the possibility to simulate the streams of visitors with ABM methodology.

Peer reviewed Agent-based Renewables model for Integrated Sustainable Energy (ARISE)

Anthony Halog Muhammad Indra Al Irsyad Rabindra Nepal | Published Wednesday, November 29, 2017 | Last modified Friday, October 05, 2018ARISE is a hybrid energy model incorporating macroeconomic data, micro socio-economic data, engineering data and environmental data. This version of ARISE can simulate scenarios of solar energy policy for Indonesia case.

Displaying 10 of 1185 results for "Ian M Hamilton" clear search