About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 1115 results for "Elena A. Pearce" clear search

The Regional Security Game: An Agent-based, Evolutionary Model of Strategic Evolution and Stability

Anthony Skews | Published Saturday, June 09, 2018The Regional Security Game is a iterated public goods game with punishement based on based on life sciences work by Boyd et al. (2003 ) and Hintze & Adami (2015 ), with modifications appropriate for an international relations setting. The game models a closed regional system in which states compete over the distribution of common security benefits. Drawing on recent work applying cultural evolutionary paradigms in the social sciences, states learn through imitation of successful strategies rather than making instrumentally rational choices. The model includes the option to fit empirical data to the model, with two case studies included: Europe in 1933 on the verge of war and south-east Asia in 2013.

Peer reviewed Applying Brantingham’s Neutral Model of Stone Raw Material Procurement to the Pinnacle Point Middle Stone Age Record, Western Cape, South Africa

Marco Janssen Simen Oestmo Haley Cawthra | Published Sunday, March 10, 2019This model is an application of Brantingham’s neutral model to a real landscape with real locations of potential sources. The sources are represented as their sizes during current conditions, and from marine geophysics surveys, and the agent starts at a random location in Mossel Bay Region (MBR) surrounding the Archaeological Pinnacle Point (PP) locality, Western Cape, South Africa. The agent moves at random on the landscape, picks up and discards raw materials based only upon space in toolkit and probability of discard. If the agent happens to encounter the PP locality while moving at random the agent may discard raw materials at it based on the discard probability.

GenoScope

Kristin Crouse | Published Wednesday, May 29, 2024 | Last modified Wednesday, April 09, 2025GenoScope is a modular agent-based model designed to simulate how cells respond to environmental stressors or other treatment conditions across species. Genes, treatment conditions, and cell physiology outcomes are represented as interacting agents that influence each other’s behavior over time. Rather than imposing fixed interaction rules, GenoScope initializes with randomized regulatory logic and calibrates rule sets based on empirical data. Calibration is grounded in a common-garden experiment involving 16 mammalian species—including humans, dolphins, bats, and camels—exposed to varying levels of temperature, glucose, and oxygen. This comparative approach enables the identification of mechanisms by which animal cells achieve robustness under extreme environmental conditions.

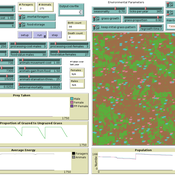

Peer reviewed The Megafauna Hunting Pressure Model

Isaac Ullah Miriam C. Kopels | Published Friday, February 16, 2024 | Last modified Friday, October 11, 2024The Megafaunal Hunting Pressure Model (MHPM) is an interactive, agent-based model designed to conduct experiments to test megaherbivore extinction hypotheses. The MHPM is a model of large-bodied ungulate population dynamics with human predation in a simplified, but dynamic grassland environment. The overall purpose of the model is to understand how environmental dynamics and human predation preferences interact with ungulate life history characteristics to affect ungulate population dynamics over time. The model considers patterns in environmental change, human hunting behavior, prey profitability, herd demography, herd movement, and animal life history as relevant to this main purpose. The model is constructed in the NetLogo modeling platform (Version 6.3.0; Wilensky, 1999).

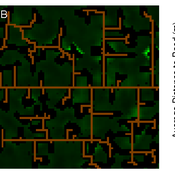

Concession Forestry Modeling

Andrew Bell Daniel G Brown Rick L Riolo Jacqueline M Doremus Thomas P Lyon John Vandermeer Arun Agrawal | Published Thursday, January 23, 2014A logging agent builds roads based on the location of high-value hotspots, and cuts trees based on road access. A forest monitor sanctions the logger on observed infractions, reshaping the pattern of road development.

MCR Model

Davide Secchi Nuno R Barros De Oliveira | Published Friday, July 22, 2016 | Last modified Saturday, January 23, 2021The aim of the model is to define when researcher’s assumptions of dependence or independence of cases in multiple case study research affect the results — hence, the understanding of these cases.

Peer reviewed Minding Norms in an Epidemic Does Matter

Klaus G. Troitzsch | Published Saturday, February 27, 2021 | Last modified Monday, September 13, 2021This paper tries to shed some light on the mutual influence of citizen behaviour and the spread of a virus in an epidemic. While the spread of a virus from infectious to susceptible persons and the outbreak of an infection leading to more or less severe illness and, finally, to recovery and immunity or death has been modelled with different kinds of models in the past, the influence of certain behaviours to keep the epidemic low and to follow recommendations of others to apply these behaviours has rarely been modelled. The model introduced here uses a theory of the effect of norm invocations among persons to find out the effect of spreading norms interacts with the progress of an epidemic. Results show that norm invocations matter. The model replicates the histories of the COVID-19 epidemic in various region, including “second waves” (but only until the end of 2021 as afterwards the official statistics ceased to be reliable as many infected persons did not report their positive test results after countermeasures were relieved), and shows that the calculation of the reproduction numbers from current reported infections usually overestimates the “real” but in practice unobservable reproduction number.

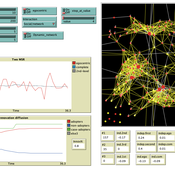

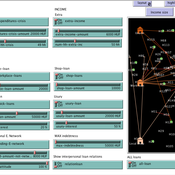

Peer reviewed Credit and debt market of low-income families

Márton Gosztonyi | Published Tuesday, December 12, 2023 | Last modified Friday, January 19, 2024The purpose of the Credit and debt market of low-income families model is to help the user examine how the financial market of low-income families works.

The model is calibrated based on real-time data which was collected in a small disadvantaged village in Hungary it contains 159 households’ social network and attributes data.

The simulation models the households’ money liquidity, expenses and revenue structures as well as the formal and informal loan institutions based on their network connections. The model forms an intertwined system integrated in the families’ local socioeconomic context through which families handle financial crises and overcome their livelihood challenges from one month to another.

The simulation-based on the abstract model of low-income families’ financial survival system at the bottom of the pyramid, which was described in following the papers:

…

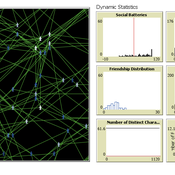

The Friendship Field

Eva Timmer Chrisja van de Kieft | Published Thursday, May 26, 2022 | Last modified Tuesday, August 30, 2022The Friendship Field model aims at modelling friendship formation based on three factors: Extraversion, Resemblance and Status, where social interaction is motivated by the Social Battery. Social Battery is one’s energy and motivation to engage in social contact. Since social contact is crucial for friendship formation, the model included Social Battery to affect social interactions. To our best knowledge, Social Battery is a yet unintroduced concept in research while it is a dynamic factor influencing the social interaction besides one’s characteristics. Extraverts’ Social Batteries charge while interacting and exhaust while being alone. Introverts’ Social Batteries charge while being alone and exhaust while interacting. The aim of the model is to illustrate the concept of Social Battery. Moreover, the Friendship Field shows patterns regarding Extraversion, Resemblance and Status including the mere-exposure effect and friendship by similarity. For the implementation of Status, Kemper’s status-power theory is used. The concept of Social Battery is also linked to Kemper’s theory on the organism as reference group. By running the model for a year (3 interactions moments per day), the friendship dynamics over time can be studied.

We presented the model at the Social Simulation Conference 2022.

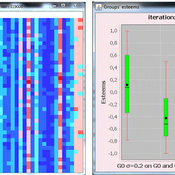

Gender differentiation model

Sylvie Huet | Published Monday, April 20, 2020 | Last modified Thursday, April 23, 2020This is a gender differentiation model in terms of reputations, prestige and self-esteem (presented in the paper https://journals.plos.org/plosone/article?id=10.1371/journal.pone.0236840). The model is based on the influence function of the Leviathan model (Deffuant, Carletti, Huet 2013 and Huet and Deffuant 2017) considering two groups.

This agent-based model studies how inequalities can be explained by the difference of open-mindness between two groups of interacting agents. We consider agents having an opinion/esteem about each other and about themselves. During dyadic meetings, agents change their respective opinion about each other and possibly about other agents they gossip about, with a noisy perception of the opinions of their interlocutor. Highly valued agents are more influential in such encounters. We study an heterogeneous population of two different groups: one more open to influence of others, taking less into account their perceived difference of esteem, called L; a second one less prone to it, called S, who designed the credibility they give to others strongly based on how higher or lower valued than themselves they perceive them.

We show that a mixed population always turns in favor to some agents belonging to the group of less open-minded agents S, and harms the other group: (1) the average group self-opinion or reputation of S is always better than the one of L; (2) the higher rank in terms of reputation are more frequently occupied by the S agents while the L agents occupy more the bottom rank; (3) the properties of the dynamics of differentiation between the two groups are similar to the properties of the glass ceiling effect proposed by Cotter et al (2001).

Displaying 10 of 1115 results for "Elena A. Pearce" clear search