About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 1110 results for "Oto Hudec" clear search

This agent-based model (ABM), developed in NetLogo and available on the COMSES repository, simulates a stylized, competitive electricity market to explore the effects of carbon pricing policies under conditions of technological innovation. Unlike traditional models that treat innovation as exogenous, this ABM incorporates endogenous innovation dynamics, allowing clean technology costs to evolve based on cumulative deployment (Wright’s Law) or time (Moore’s Law). Electricity generation companies act as agents, making investment decisions across coal, gas, wind, and solar PV technologies based on expected returns and market conditions. The model evaluates three policy scenarios—No Policy, Emissions Trading System (ETS), and Carbon Tax—within a merit-order market framework. It is partially empirically grounded, using real-world data for technology costs and emissions caps. By capturing emergent system behavior, this model offers a flexible and transparent tool for analyzing the transition to low-carbon electricity systems.

FRAMe (Flood Resilience Agent-Based Model)

Wenhan Feng | Published Wednesday, October 22, 2025The FRAMe (Flood Resilience Agent-Based Model) serves as a framework designed to simulate flood resilience dynamics at the community level, focusing on a rural settlement in the Mekong River Basin. Integrating empirical data from extensive surveys, Bayesian networks, and hydrological simulations, the framework quantifies resilience as a trade-off between robustness (resistance to damage) and adaptability (capacity for dynamic response). Agents include households, governments, and other actors, linked by social and governance networks that facilitate knowledge transfer, resource distribution, and risk communication. FRAMe incorporates mechanisms for flood forecasting, policy interventions (education, aid, insurance), and individual and collective decision-making, grounded in Protection Motivation Theory and MoHuB frameworks. The framework’s spatially explicit design leverages GIS data, which supports scenario testing of governance structures and stakeholder interactions. By examining policy scenarios and agent behavior, FRAMe aims to inform adaptive flood management strategies and enhance community resilience.

Resisting hostility

Sylvie Huet | Published Thursday, December 20, 2018We propose an agent-based model leading to a decrease or an increase of hostility between agents after a major cultural threat such as a terrorist attack. The model is inspired from the Terror Management Theory and the Social Judgement Theory. An agent has a cultural identity defined through its acceptance segments about each of three different cultural worldviews (i.e., Atheist, Muslim, Christian) of the considered society. An agent’s acceptance segment is composed from its acceptable positions toward a cultural worldview, including its most acceptable position. An agent forms an attitude about another agent depending on the similarity between their cultural identities. When a terrorist attack is perpetrated in the name of an extreme cultural identity, the negatively perceived agents from this extreme cultural identity point of view tend to decrease the width of their acceptance segments in order to differentiate themselves more from the threatening cultural identity

Peer reviewed OfficeMoves: Personalities and Performance in an Interdependent Environment

Alan Dugger | Published Thursday, June 11, 2020After a little work experience, we realize that different kinds of people prefer different work environments: some enjoy a fast-paced challenge; some want to get by; and, others want to show off.

From that experience, we also realize that different kinds of people affect their work environments differently: some increase the pace; some slow it down; and, others make it about themselves.

This model concerns how three different kinds of people affect their work environment and how that work environment affects them in return. The model explores how this circular relation between people’s preferences and their environment creates patterns of association and performance over time.

…

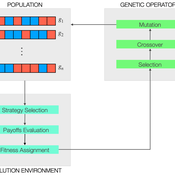

Peer reviewed Evolutionary Economic Learning Simulation: A Genetic Algorithm for Dynamic 2x2 Strategic-Form Games in Python

Vinicius Ferraz Thomas Pitz | Published Friday, April 08, 2022This project combines game theory and genetic algorithms in a simulation model for evolutionary learning and strategic behavior. It is often observed in the real world that strategic scenarios change over time, and deciding agents need to adapt to new information and environmental structures. Yet, game theory models often focus on static games, even for dynamic and temporal analyses. This simulation model introduces a heuristic procedure that enables these changes in strategic scenarios with Genetic Algorithms. Using normalized 2x2 strategic-form games as input, computational agents can interact and make decisions using three pre-defined decision rules: Nash Equilibrium, Hurwicz Rule, and Random. The games then are allowed to change over time as a function of the agent’s behavior through crossover and mutation. As a result, strategic behavior can be modeled in several simulated scenarios, and their impacts and outcomes can be analyzed, potentially transforming conflictual situations into harmony.

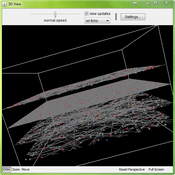

Spatio-Temporal Dynamic of Risk Model

J Jumadi | Published Tuesday, October 22, 2019 | Last modified Sunday, January 05, 2020This model aims to simlulate the dynamic of risk over time and space.

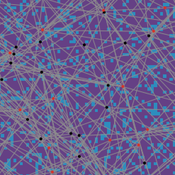

An Agent-Based Model of Insurance Customer Behaviour with Word of Mouth Network in C#

Rei England Iqbal Owadally Douglas Wright | Published Friday, March 04, 2022This is an agent-based model with two types of agents: customers and insurers. Insurers are price-takers who choose how much to spend on their service quality, and customers evaluate insurers based on premium, brand preference, and their perceived service quality. Customers are also connected in a small-world network and may share their opinions with their network.

The ABM contains two types of agents: insurers and customers. These act within the environment of a motor insurance market. At each simulation, the model undergoes the following steps:

- Network generation: At the start of the simulation, the model generates a small world network of social links between the customers, and randomly assigns each customer to an initial insurer ...

Model of Context Switching with Segregation

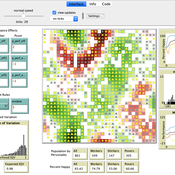

Davide Nunes | Published Thursday, August 02, 2012 | Last modified Saturday, April 27, 2013In the context switching model, a society of agents embedded in multiple social relations, engages in a simple abstract game: the consensus game. Each agent has to choose towards one of two possible choices which are basically arbitrary. The objective of the game is to reach a global consensus, but the particular choice that gets collectively selected is irrelevant.

Agent-based Modelling of Unsustainable and Sustainable Norms Under Resource Constraints

Fachrizal Sinaga Adrian Thomas Sufyan Fawwad | Published Monday, November 24, 2025This model explores the coupled dynamics of social norm diffusion and finite resource depletion. Extending the “Affordance Landscape” framework by Kaaronen & Strelkovskii (2020), this simulation investigates how resource scarcity and regeneration rates influence the adoption of pro-environmental behaviours.

The model addresses the gap by linking behavioural norms to a depleting common-pool resource. It tests whether sustainable norms can diffuse rapidly enough to prevent ecological collapse and identifies “tipping points” where resource scarcity acts as a driver for behavioural change.

An agent-based artificial stock with a dynamic investor network

Matthew Oldham | Published Tuesday, June 25, 2019The model is an agent-based artificial stock market where investors connect in a dynamic network. The network is dynamic in the sense that the investors, at specified intervals, decide whether to keep their current adviser (those investors they receive trading advise from). The investors also gain information from a private source and share public information about the risky asset. Investors have different tendencies to follow the different information sources, consider differing amounts of history, and have different thresholds for investing.

Displaying 10 of 1110 results for "Oto Hudec" clear search