About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 238 results for "Marcel Volosin" clear search

Peer reviewed General Housing Model

J M Applegate | Published Thursday, May 07, 2020The General Housing Model demonstrates a basic housing market with bank lending, renters, owners and landlords. This model was developed as a base to which students contributed additional functions during Arizona State University’s 2020 Winter School: Agent-Based Modeling of Social-Ecological Systems.

Replicating the Macy & Sato Model: Trust, Cooperation and Market Formation in the U.S. and Japan

Oliver Will | Published Saturday, August 29, 2009 | Last modified Saturday, April 27, 2013A replication of the model “Trust, Cooperation and Market Formation in the U.S. and Japan” by Michael W. Macy and Yoshimichi Sato.

Social Innovation Model

Jiin Jung | Published Monday, April 28, 2025This research aims to uncover the micro-mechanisms that drive the macro-level relationship between cultural tolerance and innovation. We focus on the indirect influence of minorities—specifically, workers with diverse domain expertise—within collaboration networks. We propose that minority influence from individuals with different expertise can serve as a key driver of organizational innovation, particularly in dynamic market environments, and that cultural tolerance is critical for enabling such minority-induced innovation. Our model demonstrates that seemingly conflicting empirical patterns between cultural tightness/looseness and innovation can emerge from the same underlying micro-mechanisms, depending on parameter values. A systematic simulation experiment revealed an optimal cultural configuration: a medium level of tolerance (t = 0.6) combined with low consistency (κ = 0.05) produced the fastest adaptation to abrupt market changes. These findings provide evidence that indirect minority influence is a core micro-mechanism linking cultural tolerance to innovation.

Bargaining with misvaluation

Marcin Czupryna | Published Wednesday, January 14, 2026Subjective biases and errors systematically affect market equilibria, whether at the population level or in bilateral trading. Here, we consider the possibility that an agent engaged in bilateral trading is mistaken about her own valuation of the good she expects to trade, that has not been explicitly incorporated into the existing bilateral trade literature. Although it may sound paradoxical that a subjective private valuation is something an agent can be mistaken about, as it is up to her to fix it, we consider the case in which that agent, seller or buyer, consciously or not, given the structure of a market, a type of good, and a temporary lack of information, may arrive at an erroneous valuation. The typical context through which this possibility may arise is in relation with so-called experience goods, which are sold while all their intrinsic qualities are still unknown (such as untasted bottled fine wines). We model this “private misvaluation” phenomenon in our study. The agents may also be mistaken about how their exchange counterparties are themselves mistaken. Formally, they attribute a certain margin of error to the other agent, which can differ from the actual way that another agent misvalues the good under consideration. This can constitute the source of a second-order misvaluation. We model different attitudes and situations in which agents face unexpected signals from their counterparties and the manner and extent to which they revise their initial beliefs. We analyse and simulate numerically the consequences of first-order and second-order misvaluation on market equilibria.

Population dynamics

Marco Janssen | Published Monday, December 31, 2018Simple population dynamics model used in Introduction to Agent-Based Modeling by Marco Janssen. For more information see https://intro2abm.com/

Behavioural parallel trading systems

Marcin Czupryna | Published Friday, June 26, 2020This model simulates the behaviour of the agents in 3 wine markets parallel trading systems: Liv-ex, Auctions and additionally OTC market (finally not used). Behavioural aspects (impatience) is additionally modeled. This is an extention of parallel trading systems model with technical trading (momentum and contrarian) and noise trading.

STECCAR: a simulation of the diffusion of electric cars

A Kangur Lc Verbrugge W Jager M Bockarjova | Published Sunday, November 29, 2015In this Repast model the ‘Consumat’ cognitive framework is applied to an ABM of the Dutch car market. Different policy scenarios can be selected or created to examine their effect on the diffusion of EVs.

The dynamic agent-based model of market of single commodity and process of setting of prices

Mark Voronovitsky | Published Saturday, January 24, 2009 | Last modified Saturday, April 27, 2013The dynamic agent based model of system which turn out the self-adjusting system, are considered in this text.

Diffusion of innovations

Marco Janssen | Published Tuesday, January 14, 20203 simple models to illustrate diffusion of innovations.

The models are discussed in Introduction to Agent-Based Modeling by Marco Janssen. For more information see https://intro2abm.com/

Demography, Industry and Residential Choice (DIReC) model

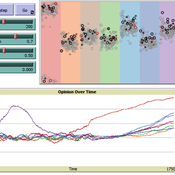

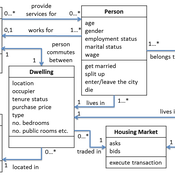

Jiaqi Ge | Published Wednesday, September 04, 2019The integrated and spatially-explicit ABM, called DIReC (Demography, Industry and Residential Choice), has been developed for Aberdeen City and the surrounding Aberdeenshire (Ge, Polhill, Craig, & Liu, 2018). The model includes demographic (individual and household) models, housing infrastructure and occupancy, neighbourhood quality and evolution, employment and labour market, business relocation, industrial structure, income distribution and macroeconomic indicators. DIReC includes a detailed spatial housing model, basing preference models on house attributes and multi-dimensional neighbourhood qualities (education, crime, employment etc.).

The dynamic ABM simulates the interactions between individuals, households, the labour market, businesses and services, neighbourhoods and economic structures. It is empirically grounded using multiple data sources, such as income and gender-age distribution across industries, neighbourhood attributes, business locations, and housing transactions. It has been used to study the impact of economic shocks and structural changes, such as the crash of oil price in 2014 (the Aberdeen economy heavily relies on the gas and oil sector) and the city’s transition from resource-based to a green economy (Ge, Polhill, Craig, & Liu, 2018).

Displaying 10 of 238 results for "Marcel Volosin" clear search