About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 519 results for "Mark Orr" clear search

Peer reviewed An Agent-Based Model of Campaign-Based Watershed Management

Samuel Assefa Aad Kessler Luuk Fleskens | Published Monday, September 21, 2020 | Last modified Friday, June 04, 2021The model simulates the national Campaign-Based Watershed Management program of Ethiopia. It includes three agents (farmers, Kebele/ village administrator, extension workers) and the physical environment that interact with each other. The physical environment is represented by patches (fields). Farmers make decisions on the locations of micro-watersheds to be developed, participation in campaign works to construct soil and water conservation structures, and maintenance of these structures. These decisions affect the physical environment or generate model outcomes. The model is developed to explore conditions that enhance outcomes of the program by analyzing the effect on the area of land covered and quality of soil and water conservation structures of (1) enhancing farmers awareness and motivation, (2) establishing and strengthening micro-watershed associations, (3) introducing alternative livelihood opportunities, and (4) enhancing the commitment of local government actors.

HyperMu’NmGA - Effect of Hypermutation Cycles in a NetLogo Minimal Genetic Algorithm

Cosimo Leuci | Published Tuesday, October 27, 2020 | Last modified Sunday, July 31, 2022A minimal genetic algorithm was previously developed in order to solve an elementary arithmetic problem. It has been modified to explore the effect of a mutator gene and the consequent entrance into a hypermutation state. The phenomenon seems relevant in some types of tumorigenesis and in a more general way, in cells and tissues submitted to chronic sublethal environmental or genomic stress.

For a long time, some scholars suppose that organisms speed up their own evolution by varying mutation rate, but evolutionary biologists are not convinced that evolution can select a mechanism promoting more (often harmful) mutations looking forward to an environmental challenge.

The model aims to shed light on these controversial points of view and it provides also the features required to check the role of sex and genetic recombination in the mutator genes diffusion.

The spread of scientific methods within and between communities

Paul Smaldino Cailin O'Connor | Published Monday, August 29, 2022We consider scientific communities where each scientist employs one of two characteristic methods: an “adequate” method (A) and a “superior” method (S). The quality of methodology is relevant to the epistemic products of these scientists, and generate credit for their users. Higher-credit methods tend to be imitated, allowing to explore whether communities will adopt one method or the other. We use the model to examine the effects of (1) bias for existing methods, (2) competence to assess relative value of competing methods, and (3) two forms of interdisciplinarity: (a) the tendency for members of a scientific community to receive meaningful credit assignment from those outside their community, and (b) the tendency to consider new methods used outside their community. The model can be used to show how interdisciplinarity can overcome the effects of bias and incompetence for the spread of superior methods.

Agent-Based Model for the Evolution of Ethnocentrism

Max Hartshorn | Published Saturday, March 24, 2012 | Last modified Saturday, April 27, 2013This is an implementation of an agent based model for the evolution of ethnocentrism. While based off a model published by Hammond and Axelrod (2006), the code has been modified to allow for a more fine-grained analysis of evolutionary dynamics.

CONSERVAT

Pieter Van Oel | Published Monday, April 13, 2015The CONSERVAT model evaluates the effect of social influence among farmers in the Lake Naivasha basin (Kenya) on the spatiotemporal diffusion pattern of soil conservation effort levels and the resulting reduction in lake sedimentation.

Agent-based model of team decision-making in hidden profile situations

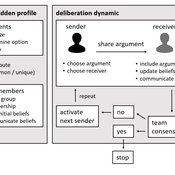

Andreas Flache Jonas Stein Vincenz Frey | Published Thursday, April 20, 2023 | Last modified Friday, November 17, 2023The model presented here is extensively described in the paper ‘Talk less to strangers: How homophily can improve collective decision-making in diverse teams’ (forthcoming at JASSS). A full replication package reproducing all results presented in the paper is accessible at https://osf.io/76hfm/.

Narrative documentation includes a detailed description of the model, including a schematic figure and an extensive representation of the model in pseudocode.

The model develops a formal representation of a diverse work team facing a decision problem as implemented in the experimental setup of the hidden-profile paradigm. We implement a setup where a group seeks to identify the best out of a set of possible decision options. Individuals are equipped with different pieces of information that need to be combined to identify the best option. To this end, we assume a team of N agents. Each agent belongs to one of M groups where each group consists of agents who share a common identity.

The virtual teams in our model face a decision problem, in that the best option out of a set of J discrete options needs to be identified. Every team member forms her own belief about which decision option is best but is open to influence by other team members. Influence is implemented as a sequence of communication events. Agents choose an interaction partner according to homophily h and take turns in sharing an argument with an interaction partner. Every time an argument is emitted, the recipient updates her beliefs and tells her team what option she currently believes to be best. This influence process continues until all agents prefer the same option. This option is the team’s decision.

Agent-based model of sexual partnership

Andrea Knittel | Published Monday, December 05, 2011 | Last modified Saturday, April 27, 2013In this model agents meet, evaluate one another, decide whether or not to date, if and when to become sexual partners, and when to break up.

Food supply chain innovations under public pressure

Tim Verwaart Wil Hennen Jan Buurma | Published Friday, April 15, 2016 | Last modified Tuesday, November 27, 2018Aroused public opinion has led to public debates on social responsibility issues in food supply chains. This model based op opinion dynamics and the linkages between involved actors simulates the public debate leading to the transitions.

A replication and extension of the Taylor's Simulation Model of Insurance Market Dynamics in C#

Rei England | Published Sunday, September 24, 2023A simple model is constructed using C# in order to to capture key features of market dynamics, while also producing reasonable results for the individual insurers. A replication of Taylor’s model is also constructed in order to compare results with the new premium setting mechanism. To enable the comparison of the two premium mechanisms, the rest of the model set-up is maintained as in the Taylor model. As in the Taylor example, homogeneous customers represented as a total market exposure which is allocated amongst the insurers.

In each time period, the model undergoes the following steps:

1. Insurers set competitive premiums per exposure unit

2. Losses are generated based on each insurer’s share of the market exposure

3. Accounting results are calculated for each insurer

…

An Agent Based Model of International Capital Flows

Harvey Baldovino | Published Thursday, April 06, 2023This is a preliminary attempt in creating an Agent-Based Model of capital flows. This is based on the theory of capital flows based on interest-rate differentials. Foreign capital flows to a country with higher interest rates relative to another. The model shows how capital volatilty and wealth concentration are affected by the speed of capital flow, number of investors, magnitude of changes in interest rate due to capital flows and the interest differential threshold that investors set in deciding whether to move capital or not. Investors in the model are either “regional” investors (only investing in neighboring countries) and “global” investors (those who invest anywhere in the world).

In the future, the author hopes to extend this model to incorporate capital flow based on changes in macroeconomic fundamentals, exchange rate volatility, behavioral finance (for instance, herding behavior) and the presence of capital controls.

Displaying 10 of 519 results for "Mark Orr" clear search