About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 519 results for "Mark Orr" clear search

An Agent-Based Model of an Insurer's Estimated Capital Requirement in a Simple Insurance Market with Imperfect Information in C#

Rei England | Published Sunday, September 24, 2023This is an agent-based model of a simple insurance market with two types of agents: customers and insurers. Insurers set premium quotes for each customer according to an estimation of their underlying risk based on past claims data. Customers either renew existing contracts or else select the cheapest quote from a subset of insurers. Insurers then estimate their resulting capital requirement based on a 99.5% VaR of their aggregate loss distributions. These estimates demonstrate an under-estimation bias due to the winner’s curse effect.

A basic macroeconomic agent-based model for analyzing monetary regime shifts

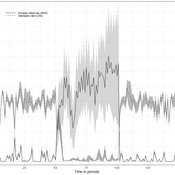

Oliver Reinhardt Florian Peters Doris Neuberger Adelinde Uhrmacher | Published Tuesday, May 03, 2022In macroeconomics, an emerging discussion of alternative monetary systems addresses the dimensions of systemic risk in advanced financial systems. Monetary regime changes with the aim of achieving a more sustainable financial system have already been discussed in several European parliaments and were the subject of a referendum in Switzerland. However, their effectiveness and efficacy concerning macro-financial stability are not well-known. This paper introduces a macroeconomic agent-based model (MABM) in a novel simulation environment to simulate the current monetary system, which may serve as a basis to implement and analyze monetary regime shifts. In this context, the monetary system affects the lending potential of banks and might impact the dynamics of financial crises. MABMs are predestined to replicate emergent financial crisis dynamics, analyze institutional changes within a financial system, and thus measure macro-financial stability. The used simulation environment makes the model more accessible and facilitates exploring the impact of different hypotheses and mechanisms in a less complex way. The model replicates a wide range of stylized economic facts, including simplifying assumptions to reduce model complexity.

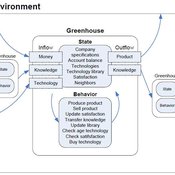

Universal Darwinism in Dutch Greenhouses

Julia Kasmire | Published Wednesday, May 09, 2012 | Last modified Saturday, April 27, 2013An ABM, derived from a case study and a series of surveys with greenhouse growers in the Westland, Netherlands. Experiments using this model showshow that the greenhouse horticulture industry displays diversity, adaptive complexity and an uneven distribution, which all suggest that the industry is an evolving system.

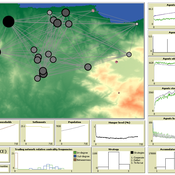

AncientS-ABM: Agent-Based Modeling of Past Societies Social Organization

Angelos Chliaoutakis | Published Thursday, April 09, 2020AncientS-ABM is an agent-based model for simulating and evaluating the potential social organization of an artificial past society, configured by available archaeological data. Unlike most existing agent-based models used in archaeology, our ABM framework includes completely autonomous, utility-based agents. It also incorporates different social organization paradigms, different decision-making processes, and also different cultivation technologies used in ancient societies. Equipped with such paradigms, the model allows us to explore the transition from a simple to a more complex society by focusing on the historical social dynamics; and to assess the influence of social organization on agents’ population growth, agent community numbers, sizes and distribution.

AncientS-ABM also blends ideas from evolutionary game theory with multi-agent systems’ self-organization. We model the evolution of social behaviours in a population of strategically interacting agents in repeated games where they exchange resources (utility) with others. The results of the games contribute to both the continuous re-organization of the social structure, and the progressive adoption of the most successful agent strategies. Agent population is not fixed, but fluctuates over time, while agents in stage games also receive non-static payoffs, in contrast to most games studied in the literature. To tackle this, we defined a novel formulation of the evolutionary dynamics via assessing agents’ rather than strategies’ fitness.

As a case study, we employ AncientS-ABM to evaluate the impact of the implemented social organization paradigms on an artificial Bronze Age “Minoan” society, located at different geographical parts of the island of Crete, Greece. Model parameter choices are based on archaeological evidence and studies, but are not biased towards any specific assumption. Results over a number of different simulation scenarios demonstrate better sustainability for settlements consisting of and adopting a socio-economic organization model based on self-organization, where a “heterarchical” social structure emerges. Results also demonstrate that successful agent societies adopt an evolutionary approach where cooperation is an emergent strategic behaviour. In simulation scenarios where the natural disaster module was enabled, we observe noticeable changes in the settlements’ distribution, relating to significantly higher migration rates immediately after the modeled Theran eruption. In addition, the initially cooperative behaviour is transformed to a non-cooperative one, thus providing support for archaeological theories suggesting that the volcanic eruption led to a clear breakdown of the Minoan socio-economic system.

…

Organizational Bundle Theory

Alhaji Cherif | Published Monday, December 15, 2008 | Last modified Saturday, April 27, 2013This model demonstrates the spread of collapse through a network. The model is abstract but has many applications in various fields.

Optimal Trading Strategies of Agents in a Population of Firms: An Agent-Based Approach to Soccer Transfer Markets

Kehinde Salau | Published Tuesday, December 16, 2008 | Last modified Saturday, April 27, 2013Default Initial skill, read ODD for more info. The purpose of the model presented by Salau is to study the ’player profit vs. club benefit’ dilemma present in professional soccer organizations.

Relational Social Interaction Model of Migration (RSIMM)

Christopher Roberts Sean Bergin | Published Monday, February 07, 2011 | Last modified Saturday, April 27, 2013Current trends suggest that when individuals of different cultural backgrounds encounter one another, their social categories become entangled and create new hybridized or creole identities.

Managing Connectivity: insights from modelling species interactions accross multiple scales in an idealized landscape

Marco Janssen Michael Schoon Jacopo A. Baggio Kehinde Salau | Published Monday, October 01, 2012 | Last modified Monday, January 20, 2014The model objective’s is to explore the management choice set to uncover which subsets of strategies are most effective at maximizing species coexistence on a fragmented landscape.

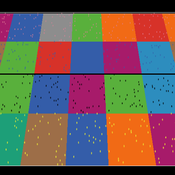

Collective Behavior of In-group Favoritism

Meysam Alizadeh Andrew Crooks Claudio Cioffi-Revilla | Published Tuesday, September 01, 2015We investigate the interplay of homophily, differentiation, and in-group cooperation mechanisms on the formation of opinion clusters and emergence of radical opinions.

Salzburg Bicycle model

Gudrun Wallentin | Published Saturday, October 29, 2016An ABM to simulate the spatio-temporal distribution of cyclists across the road network of the city of Salzburg.

Displaying 10 of 519 results for "Mark Orr" clear search