About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 376 results for "Huw Vasey" clear search

OMOLAND-CA: An Agent-Based Modeling of Rural Households’ Adaptation to Climate Change

Atesmachew Hailegiorgis Andrew Crooks Claudio Cioffi-Revilla | Published Tuesday, July 25, 2017 | Last modified Tuesday, July 10, 2018The purpose of the OMOLAND-CA is to investigate the adaptive capacity of rural households in the South Omo zone of Ethiopia with respect to variation in climate, socioeconomic factors, and land-use at the local level.

The Informational Dynamics of Regime Change

Dominik Klein Johannes Marx | Published Saturday, October 07, 2017 | Last modified Tuesday, January 14, 2020We model the epistemic dynamics preceding political uprising. Before deciding whether to start protests, agents need to estimate the amount of discontent with the regime. This model simulates the dynamics of group knowledge about general discontent.

Simulation of the Governance of Complex Systems

Fabian Adelt Johannes Weyer Robin D Fink Andreas Ihrig | Published Monday, December 18, 2017 | Last modified Friday, March 02, 2018Simulation-Framework to study the governance of complex, network-like sociotechnical systems by means of ABM. Agents’ behaviour is based on a sociological model of action. A set of basic governance mechanisms helps to conduct first experiments.

Peer reviewed Credit and debt market of low-income families

Márton Gosztonyi | Published Tuesday, December 12, 2023 | Last modified Friday, January 19, 2024The purpose of the Credit and debt market of low-income families model is to help the user examine how the financial market of low-income families works.

The model is calibrated based on real-time data which was collected in a small disadvantaged village in Hungary it contains 159 households’ social network and attributes data.

The simulation models the households’ money liquidity, expenses and revenue structures as well as the formal and informal loan institutions based on their network connections. The model forms an intertwined system integrated in the families’ local socioeconomic context through which families handle financial crises and overcome their livelihood challenges from one month to another.

The simulation-based on the abstract model of low-income families’ financial survival system at the bottom of the pyramid, which was described in following the papers:

…

Peer reviewed Dynamic Value-based Cognitive Architectures

Bart de Bruin | Published Tuesday, November 30, 2021The intention of this model is to create an universal basis on how to model change in value prioritizations within social simulation. This model illustrates the designing of heterogeneous populations within agent-based social simulations by equipping agents with Dynamic Value-based Cognitive Architectures (DVCA-model). The DVCA-model uses the psychological theories on values by Schwartz (2012) and character traits by McCrae and Costa (2008) to create an unique trait- and value prioritization system for each individual. Furthermore, the DVCA-model simulates the impact of both social persuasion and life-events (e.g. information, experience) on the value systems of individuals by introducing the innovative concept of perception thermometers. Perception thermometers, controlled by the character traits, operate as buffers between the internal value prioritizations of agents and their external interactions. By introducing the concept of perception thermometers, the DVCA-model allows to study the dynamics of individual value prioritizations under a variety of internal and external perturbations over extensive time periods. Possible applications are the use of the DVCA-model within artificial sociality, opinion dynamics, social learning modelling, behavior selection algorithms and social-economic modelling.

Friendship Games Rev 1.0

David Dixon | Published Friday, October 07, 2011 | Last modified Saturday, April 27, 2013A friendship game is a kind of network game: a game theory model on a network. This is a NetLogo model of an agent-based adaptation of “‘Friendship-based’ Games” by PJ Lamberson. The agents reach an equilibrium that depends on the strategy played and the topology of the network.

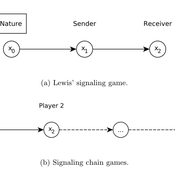

Lewis' Signaling Chains

Giorgio Gosti | Published Wednesday, January 14, 2015 | Last modified Friday, April 03, 2015Signaling chains are a special case of Lewis’ signaling games on networks. In a signaling chain, a sender tries to send a single unit of information to a receiver through a chain of players that do not share a common signaling system.

Private forest owner management behavior using social interactions, information flow, and peer-to-peer n

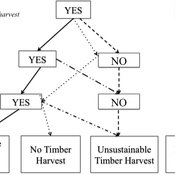

Jessica Leahy Emily Silver Huff Aaron R Weiskittel Caroline L Noblet David Hiebeler | Published Tuesday, October 13, 2015This theoretical model includes forested polygons and three types of agents: forest landowners, foresters, and peer leaders. Agent rules and characteristics were parameterized from existing literature and an empirical survey of forest landowners.

An age and/or gender-based division of labor during the Last Glacial Maximum in Iberia through rabbit hunting

Liliana Perez Samuel Seuru Ariane Burke | Published Friday, July 07, 2023Many archaeological assemblages from the Iberian Peninsula dated to the Last Glacial Maximum contain large quantities of European rabbit (Oryctolagus cuniculus) remains with an anthropic origin. Ethnographic and historic studies report that rabbits may be mass-collected through warren-based harvesting involving the collaborative participation of several persons.

We propose and implement an Agent-Based Model grounded in the Optimal Foraging Theory and the Diet Breadth Model to examine how different warren-based hunting strategies influence the resulting human diets.

Particularly, this model is developed to test the following hypothesis: What if an age and/or gender-based division of labor was adopted, in which adult men focus on large prey hunting, and women, elders and children exploit warrens?

…

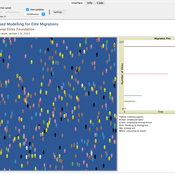

An Agent-Based Model for Skilled Workers Migration

Hassan Bashiri | Published Thursday, September 21, 2023This documentation provides an overview and explanation of the NetLogo simulation code for modeling skilled workers’ migration in Iran. The simulation aims to explore the dynamics of skilled workers’ migration and their transition through various states, including training, employment, and immigration.

The flow of elite and talent migration, or “brain drain,” is a complex issue with far-reaching implications for developing countries. The decision to migrate is made due to various factors including economic opportunities, political stability, social factors and personal circumstances.

Measuring individual interests in the field of immigration is a complex task that requires careful consideration of various factors. The agent-based model is a useful tool for understanding the complex factors that are involved in talent migration. By considering the various social, economic, and personal factors that influence migration decisions, policymakers can provide more effective strategies to retain skilled and talented labor and promote sustainable growth in developing countries. One of the main challenges in studying the flow of elite migration is the complexity of the decision-making process and a set of factors that lead to migration decisions. Agent-based modeling is a useful tool for understanding how individual decisions can lead to large-scale migration patterns.

Displaying 10 of 376 results for "Huw Vasey" clear search