About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 342 results for "Tim Dorscheidt" clear search

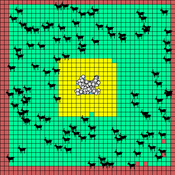

The tragedy of the park: an agent-based model on endogenous and exogenous institutions for the management of a forest.

Elena Vallino | Published Wednesday, March 27, 2013 | Last modified Thursday, April 26, 2018I model a forest and a community of loggers. Agents follow different kinds of rules in order to log. I compare the impact of endogenous and of exogenous institutions on the state of the forest and on the profit of the users, representing different scenarios of participatory conservation projects.

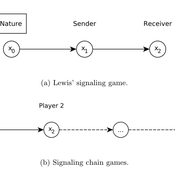

Lewis' Signaling Chains

Giorgio Gosti | Published Wednesday, January 14, 2015 | Last modified Friday, April 03, 2015Signaling chains are a special case of Lewis’ signaling games on networks. In a signaling chain, a sender tries to send a single unit of information to a receiver through a chain of players that do not share a common signaling system.

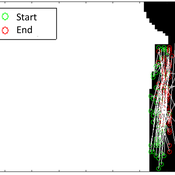

Peer reviewed MOOvPOPsurveillance

Matthew Gompper Aniruddha Belsare Joshua J Millspaugh | Published Tuesday, April 04, 2017 | Last modified Tuesday, May 12, 2020MOOvPOPsurveillance was developed as a tool for wildlife agencies to guide collection and analysis of disease surveillance data that relies on non-probabilistic methods like harvest-based sampling.

TERRoir level Organic matter Interactions and Recycling model

Myriam Grillot | Published Wednesday, April 19, 2017 | Last modified Wednesday, June 17, 2020The TERROIR agent-based model was built for the multi-level analysis of biomass and nutrient flows within agro-sylvo-pastoral villages in West Africa. It explicitly takes into account both human organization and spatial extension of such flows.

Coastal Coupled Housing and Land Markets (C-CHALMS)

Nicholas Magliocca | Published Thursday, May 18, 2017Next generation of the CHALMS model applied to a coastal setting to investigate the effects of subjective risk perception and salience decision-making on adaptive behavior by residents.

A data-informed bounded-confidence opinion dynamics model

Bruce Edmonds | Published Wednesday, March 10, 2021The simulation is a variant of the “ToRealSim OD variants - base v2.7” base model, which is based on the standard DW opinion dynamics model (but with the differences that rather than one agent per tick randomly influencing another, all agents randomly influence one other per tick - this seems to make no difference to the outcomes other than to scale simulation time). Influence can be made one-way by turning off the two-way? switch

Various additional variations and sources of noise are possible to test robustness of outcomes to these (compared to DW model).

In this version agent opinions change following the empirical data collected in some experiments (Takács et al 2016).

Such an algorithm leaves no role for the uncertainties in other OD models. [Indeed the data from (Takács et al 2016) indicates that there can be influence even when opinion differences are large - which violates a core assumption of these]. However to allow better comparison with other such models there is a with-un? switch which allows uncertainties to come into play. If this is on, then influence (according to above algorithm) is only calculated if the opinion difference is less than the uncertainty. If an agent is influenced uncertainties are modified in the same way as standard DW models.

Leviathan group model and its approximation

Thibaut Roubin Guillaume Deffuant | Published Tuesday, July 26, 2022The model is based on the influence function of the Leviathan model (Deffuant, Carletti, Huet 2013 and Huet and Deffuant 2017) with the addition of group idenetity. We aim at better explaining some patterns generated by this model, using a derived mathematical approximation of the evolution of the opinions averaged.

We consider agents having an opinion/esteem about each other and about themselves. During dyadic meetings, agents change their respective opinion about each other, and possibly about other agents they gossip about, with a noisy perception of the opinions of their interlocutor. Highly valued agents are more influential in such encounters. Moreover, each agent belongs to a single group and the opinions within the group are attracted to their average.

We show that a group hierarchy can emerges from this model, and that the inequality of reputations among groups have a negative effect on the opinions about the groups of low status. The mathematical analysis of the opinion dynamic shows that the lower the status of the group, the more detrimental the interactions with the agents of other groups are for the opinions about this group, especially when gossip is activated. However, the interactions between agents of the same group tend to have a positive effect on the opinions about this group.

On the liquidity of the illiquid (hard-to-trade) assets

Marcin Czupryna | Published Monday, January 13, 2025This paper investigates the impact of agents' trading decisions on market liquidity and transactional efficiency in markets for illiquid (hard-to-trade) assets. Drawing on a unique order book dataset from the fine wine exchange Liv-ex, we offer novel insights into liquidity dynamics in illiquid markets. Using an agent-based framework, we assess the adequacy of conventional liquidity measures in capturing market liquidity and transactional efficiency. Our main findings reveal that conventional liquidity measures, such as the number of bids, asks, new bids and new asks, may not accurately represent overall transactional efficiency. Instead, volume (measured by the number of trades) and relative spread measures may be more appropriate indicators of liquidity within the context of illiquid markets. Furthermore, our simulations demonstrate that a greater number of traders participating in the market correlates with an increased efficiency in trade execution, while wider trader-set margins may decrease the transactional efficiency. Interestingly, the trading period of the agents appears to have a significant impact on trade execution. This suggests that granting market participants additional time for trading (for example, through the support of automated trading systems) can enhance transactional efficiency within illiquid markets. These insights offer practical implications for market participants and policymakers aiming to optimise market functioning and liquidity.

E³-MAN. An Institutionally-guided multi-agent. Model for fair and efficient negotiation.

José luis bustelo | Published Monday, September 01, 2025Negotiation plays a fundamental role in shaping human societies, underpinning conflict resolution, institutional design, and economic coordination. This article introduces E³-MAN, a novel multi-agent model for negotiation that integrates individual utility maximization with fairness and institutional legitimacy. Unlike classical approaches grounded solely in game theory, our model incorporates Bayesian opponent modeling, transfer learning from past negotiation domains, and fallback institutional rules to resolve deadlocks. Agents interact in dynamic environments characterized by strategic heterogeneity and asymmetric information, negotiating over multidimensional issues under time constraints. Through extensive simulation experiments, we compare E³-MAN against the Nash bargaining solution and equal-split baselines using key performance metrics: utilitarian efficiency, Nash social welfare, Jain fairness index, Gini coefficient, and institutional compliance. Results show that E³-MAN achieves near-optimal efficiency while significantly improving distributive equity and agreement stability. A legal application simulating multilateral labor arbitration demonstrates that institutional default rules foster more balanced outcomes and increase negotiation success rates from 58% to 98%. By combining computational intelligence with normative constraints, this work contributes to the growing field of socially aware autonomous agents. It offers a virtual laboratory for exploring how simple institutional interventions can enhance justice, cooperation, and robustness in complex socio-legal systems.

A preliminary extension of the Hemelrijk 1996 model of reciprocal behavior to include feeding

Sean Barton | Published Monday, December 13, 2010 | Last modified Saturday, April 27, 2013A more complete description of the model can be found in Appendix I as an ODD protocol. This model is an expansion of the Hemelrijk (1996) that was expanded to include a simple food seeking behavior.

Displaying 10 of 342 results for "Tim Dorscheidt" clear search