About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 972 results for "Dave van Wees" clear search

Peer reviewed A financial market with zero intelligence agents

edgarkp | Published Wednesday, March 27, 2024The model’s aim is to represent the price dynamics under very simple market conditions, given the values adopted by the user for the model parameters. We suppose the market of a financial asset contains agents on the hypothesis they have zero-intelligence. In each period, a certain amount of agents are randomly selected to participate to the market. Each of these agents decides, in a equiprobable way, between proposing to make a transaction (talk = 1) or not (talk = 0). Again in an equiprobable way, each participating agent decides to speak on the supply (ask) or the demand side (bid) of the market, and proposes a volume of assets, where this number is drawn randomly from a uniform distribution. The granularity depends on various factors, including market conventions, the type of assets or goods being traded, and regulatory requirements. In some markets, high granularity is essential to capture small price movements accurately, while in others, coarser granularity is sufficient due to the nature of the assets or goods being traded

A basic macroeconomic agent-based model for analyzing monetary regime shifts

Oliver Reinhardt Florian Peters Doris Neuberger Adelinde Uhrmacher | Published Tuesday, May 03, 2022In macroeconomics, an emerging discussion of alternative monetary systems addresses the dimensions of systemic risk in advanced financial systems. Monetary regime changes with the aim of achieving a more sustainable financial system have already been discussed in several European parliaments and were the subject of a referendum in Switzerland. However, their effectiveness and efficacy concerning macro-financial stability are not well-known. This paper introduces a macroeconomic agent-based model (MABM) in a novel simulation environment to simulate the current monetary system, which may serve as a basis to implement and analyze monetary regime shifts. In this context, the monetary system affects the lending potential of banks and might impact the dynamics of financial crises. MABMs are predestined to replicate emergent financial crisis dynamics, analyze institutional changes within a financial system, and thus measure macro-financial stability. The used simulation environment makes the model more accessible and facilitates exploring the impact of different hypotheses and mechanisms in a less complex way. The model replicates a wide range of stylized economic facts, including simplifying assumptions to reduce model complexity.

Construction and Demolition model to track material flows and embodied carbon

Jonathan Edgardo Cohen | Published Monday, September 30, 2024Reusing existing material stocks in developed built environments can significantly reduce the environmental footprint of the construction and demolition sector. However, material reuse in urban areas presents technical, temporal, and geographical challenges. Although a better understanding of spatial and temporal changes in material stocks could improve city resource management, limited scientific contributions have addressed this challenge.

This study details the steps followed in developing a spatially explicit rule-based simulation of materials stock. The simulation provides a proof of concept by incorporating the spatial and temporal dimensions of construction and demolition activities to analyse how various urban parameters determine material flows and embodied carbon in urban areas. The model explores the effects of 1) re-using recycled materials, 2) demolitions, 3) renovations and 4) various building typologies.

To showcase the model’s capabilities, the residential building stock of Gothenburg City is used as a case study, and eight building materials are tracked. Environmental impacts (A1-A3) are calculated with embodied carbon factors. The main parameters are explored in a baseline scenario. Then, a second scenario focuses on a hypothetical policy that promotes improvements in building energy performance.

The simulation can be expanded to include more materials and built environment assets and allows for future explorations on, for example, the role of logistics, the implementation of recycling or reuse stations, and, in general, supporting sustainable and circular strategies from the construction sector.

Peer reviewed The Effect of Spatial Clustering on Stone Raw Material Procurement

Marco Janssen Simen Oestmo Curtis W Marean | Published Friday, April 21, 2017This model allows for the investigation of the effect spatial clustering of raw material sources has on the outcome of the neutral model of stone raw material procurement by Brantingham (2003).

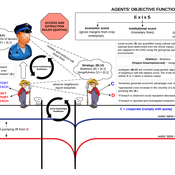

Peer reviewed E³-MAN. An Institutionally-guided multi-agent. Model for fair and efficient negotiation.

José luis bustelo | Published Monday, September 01, 2025Negotiation plays a fundamental role in shaping human societies, underpinning conflict resolution, institutional design, and economic coordination. This article introduces E³-MAN, a novel multi-agent model for negotiation that integrates individual utility maximization with fairness and institutional legitimacy. Unlike classical approaches grounded solely in game theory, our model incorporates Bayesian opponent modeling, transfer learning from past negotiation domains, and fallback institutional rules to resolve deadlocks. Agents interact in dynamic environments characterized by strategic heterogeneity and asymmetric information, negotiating over multidimensional issues under time constraints. Through extensive simulation experiments, we compare E³-MAN against the Nash bargaining solution and equal-split baselines using key performance metrics: utilitarian efficiency, Nash social welfare, Jain fairness index, Gini coefficient, and institutional compliance. Results show that E³-MAN achieves near-optimal efficiency while significantly improving distributive equity and agreement stability. A legal application simulating multilateral labor arbitration demonstrates that institutional default rules foster more balanced outcomes and increase negotiation success rates from 58% to 98%. By combining computational intelligence with normative constraints, this work contributes to the growing field of socially aware autonomous agents. It offers a virtual laboratory for exploring how simple institutional interventions can enhance justice, cooperation, and robustness in complex socio-legal systems.

Social identity approach in a data-driven Axelrod model

alejandrodinkelberg | Published Thursday, July 28, 2022Simulations based on the Axelrod model and extensions to inspect the volatility of the features over time (AXELROD MODEL & Agreement threshold & two model variations based on the Social identity approach)

The Axelrod model is used to predict the number of changes per feature in comparison to the datasets and is used to compare different model variations and their performance.

Input: Real data

…

Value Chain Marketing (VCM)

Stephanie Hintze | Published Monday, April 14, 2014 | Last modified Thursday, October 16, 2014Inspired by the SKIN model, the basic concept here is to model the acceptance and implementation of supplier innovations. This model includes three types of agents comprising suppliers, manufacturers and applicators.

The Levers of HIV Model

Arthur Hjorth Wouter Vermeer C. Hendricks Brown Uri Wilensky Can Gurkan | Published Tuesday, March 08, 2022 | Last modified Tuesday, October 31, 2023Chicago’s demographic, neighborhood, sex risk behaviors, sexual network data, and HIV prevention and treatment cascade information from 2015 were integrated as input to a new agent-based model (ABM) called the Levers-of-HIV-Model (LHM). This LHM, written in NetLogo, forms patterns of sexual relations among Men who have Sex with Men (MSM) based on static traits (race/ethnicity, and age) and dynamic states (sexual relations and practices) that are found in Chicago. LHM’s five modules simulate and count new infections at the two marker years of 2023 and 2030 for a wide range of distinct scenarios or levers, in which the levels of PrEP and ART linkage to care, retention, and adherence or viral load are increased over time from the 2015 baseline levels.

The Groundwater Commons Game

Juan Castilla-Rho Rodrigo Rojas | Published Thursday, May 11, 2017 | Last modified Saturday, September 16, 2017The Groundwater Commons Game synthesises and extends existing work on human cooperation and collective action, to elucidate possible determinants and pathways to regulatory compliance in groundwater systems globally.

WealthDistribRes

Romulus-Catalin Damaceanu | Published Friday, May 04, 2012 | Last modified Saturday, April 27, 2013This model WealthDistribRes can be used to study the distribution of wealth in function of using a combination of resources classified in two renewable and nonrenewable.

Displaying 10 of 972 results for "Dave van Wees" clear search