About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 934 results for "George Ak Van Voorn" clear search

Exploring social psychology theory for modelling farmer decision-making

James Millington | Published Tuesday, September 18, 2012 | Last modified Saturday, April 27, 2013To investigate the potential of using Social Psychology Theory in ABMs of natural resource use and show proof of concept, we present an exemplary agent-based modelling framework that explicitly represents multiple and hierarchical agent self-concepts

Hyperconnectivity, and Fact-Checking- Modeling Witnessing as a Traditional Coast Salish Mechanism

Adam Rorabaugh | Published Thursday, May 01, 2025An unintended consequence of low cost maritime travel may be hyperconnectedness, creating social situations where information can be readily passed before it is verified- an issue not limited to modern digitally connected societies. In traditional Coast Salish societies, the peoples of what is now Western Washington and Southwestern British Columbia, oral traditions were vertified through a process called witnessing. Witnesses would be trained to recount and verify oral history and traditional teachings at high fidelity. Here, a simple model based on dual inheritance approaches to genes and culture, is used to compare this specific form of verifying socially important information compared to modern mass communication. The model suggests that witnessing is a high fidelity form of transmitting knowledge with a low error rate, more in line with modern apprenticeships than mass communication. Social mechanisms such as witnessing provide solutions to issues faced in contemporary discourse where the validity of information and even fact checking mechanisms may be biased or counterfactual. This effort also demonstrates the utillity of using modeling approaches to highlight how specific, historically contingent institutions such as witnesses can be drawn upon to model potential solutions to contemporary issues solved in the past in traditional Coast Salish practice.

A data-informed bounded-confidence opinion dynamics model

Bruce Edmonds | Published Wednesday, March 10, 2021The simulation is a variant of the “ToRealSim OD variants - base v2.7” base model, which is based on the standard DW opinion dynamics model (but with the differences that rather than one agent per tick randomly influencing another, all agents randomly influence one other per tick - this seems to make no difference to the outcomes other than to scale simulation time). Influence can be made one-way by turning off the two-way? switch

Various additional variations and sources of noise are possible to test robustness of outcomes to these (compared to DW model).

In this version agent opinions change following the empirical data collected in some experiments (Takács et al 2016).

Such an algorithm leaves no role for the uncertainties in other OD models. [Indeed the data from (Takács et al 2016) indicates that there can be influence even when opinion differences are large - which violates a core assumption of these]. However to allow better comparison with other such models there is a with-un? switch which allows uncertainties to come into play. If this is on, then influence (according to above algorithm) is only calculated if the opinion difference is less than the uncertainty. If an agent is influenced uncertainties are modified in the same way as standard DW models.

Hedonic and Eudaimonic Well-being Based Reward for Intrinsic Motivated Reinforcement Learning Agents

Yue Gao Shimon Edelman | Published Monday, March 21, 2016The code contains four experiments for well-being based IMRL reward features.

Agent-based modeling of the spatio-temporal distribution of Sahelian transhumant herds

Cheick Amed Diloma Gabriel TRAORE Etienne DELAY Alassane Bah Djibril Diop | Published Tuesday, May 20, 2025Sahelian transhumance is a seasonal pastoral mobility between the transhumant’s terroir of origin and one or more host terroirs. Sahelian transhumance can last several months and extend over hundreds of kilometers. Its purpose is to ensure efficient and inexpensive feeding of the herd’s ruminants. This paper describes an agent-based model to determine the spatio-temporal distribution of Sahelian transhumant herds and their impact on vegetation. Three scenarios based on different values of rainfall and the proportion of vegetation that can be grazed by transhumant herds are simulated. The results of the simulations show that the impact of Sahelian transhumant herds on vegetation is not significant and that rainfall does not impact the alley phase of transhumance. The beginning of the rainy season has a strong temporal impact on the spatial distribution of transhumant herds during the return phase of transhumance.

The spread of scientific methods within and between communities

Paul Smaldino Cailin O'Connor | Published Monday, August 29, 2022We consider scientific communities where each scientist employs one of two characteristic methods: an “adequate” method (A) and a “superior” method (S). The quality of methodology is relevant to the epistemic products of these scientists, and generate credit for their users. Higher-credit methods tend to be imitated, allowing to explore whether communities will adopt one method or the other. We use the model to examine the effects of (1) bias for existing methods, (2) competence to assess relative value of competing methods, and (3) two forms of interdisciplinarity: (a) the tendency for members of a scientific community to receive meaningful credit assignment from those outside their community, and (b) the tendency to consider new methods used outside their community. The model can be used to show how interdisciplinarity can overcome the effects of bias and incompetence for the spread of superior methods.

EU language skills

Marco Civico | Published Sunday, July 07, 2024The objective of this agent-based model is to test different language education orientations and their consequences for the EU population in terms of linguistic disenfranchisement, that is, the inability of citizens to understand EU documents and parliamentary discussions should their native language(s) no longer be official. I will focus on the impact of linguistic distance and language learning. Ideally, this model would be a tool to help EU policy makers make informed decisions about language practices and education policies, taking into account their consequences in terms of diversity and linguistic disenfranchisement. The model can be used to force agents to make certain choices in terms of language skills acquisition. The user can then go on to compare different scenarios in which language skills are acquired according to different rationales. The idea is that, by forcing agents to adopt certain language learning strategies, the model user can simulate policies promoting the acquisition of language skills and get an idea of their impact. In this way the model allows not only to sketch various scenarios of the evolution of language skills among EU citizens, but also to estimate the level of disenfranchisement in each of these scenarios.

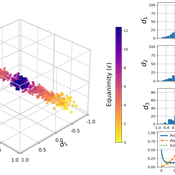

Weighted Balance Model of Issue Alignment and Polarization

David Garcia Simon Schweighofer | Published Sunday, October 08, 2023This model is pertinent to our JASSS publication “Raising the Spectrum of Polarization: Generating Issue Alignment with a Weighted Balance Opinion Dynamics Model”. It shows how, based on the mechanisms of our Weighted Balance Theory (a development of Fritz Heider’s Cognitive Balance Theory), agents can self-organize in a multi-dimensional opinion space and form an emergent ideological spectrum. The degree of issue alignment and polarization realized by the model depends mainly on the agent-specific ‘equanimity parameter’ epsilon.

Using a simple ABM to help undergraduates understand impacts of an invasive species: fish, lionfish, and zooplankton

Samantha Farquhar | Published Friday, February 24, 2023This model is an implementation of a predator-prey simulation using NetLogo programming language. It simulates the interaction between fish, lionfish, and zooplankton. Fish and lionfish are both represented as turtles, and they have their own energy level. In this simulation, lionfish eat fish, and fish eat zooplankton. Zooplankton are represented as green patches on the NetLogo world. Lionfish and fish can reproduce and gain energy by eating other turtles or zooplankton.

This model was created to help undergraduate students understand how simulation models might be helpful in addressing complex environmental problems. In this case, students were asked to use this model to make predictions about how the introduction of lionfish (considered an invasive species in some places) might alter the ecosystem.

Reflexivity in a diffusion of innovations model

César García-Díaz Carlos Cordoba | Published Thursday, May 07, 2020In this agent-based model, agents decide to adopt a new product according to a utility function that depends on two kinds of social influences. First, there is a local influence exerted on an agent by her closest neighbors that have already adopted, and also by herself if she feels the product suits her personal needs. Second, there is a global influence which leads agents to adopt when they become aware of emerging trends happening in the system. For this, we endow agents with a reflexive capacity that allows them to recognize a trend, even if they can not perceive a significant change in their neighborhood.

Results reveal the appearance of slowdown periods along the adoption rate curve, in contrast with the classic stylized bell-shaped behavior. Results also show that network structure plays an important role in the effect of reflexivity: while some structures (e.g., scale-free networks) may amplify it, others (e.g., small-world structure) weaken such an effect.

Displaying 10 of 934 results for "George Ak Van Voorn" clear search