About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 334 results for "Chelsea E Hunter" clear search

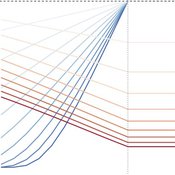

Peer reviewed Price Evolution with Expectations

J M Applegate Gesine Steudel Armin Haas Carlo Jaeger | Published Friday, September 10, 2021The Price Evolution with Expectations model provides the opportunity to explore the question of non-equilibrium market dynamics, and how and under which conditions an economic system converges to the classically defined economic equilibrium. To accomplish this, we bring together two points of view of the economy; the classical perspective of general equilibrium theory and an evolutionary perspective, in which the current development of the economic system determines the possibilities for further evolution.

The Price Evolution with Expectations model consists of a representative firm producing no profit but producing a single good, which we call sugar, and a representative household which provides labour to the firm and purchases sugar.The model explores the evolutionary dynamics whereby the firm does not initially know the household demand but eventually this demand and thus the correct price for sugar given the household’s optimal labour.

The model can be run in one of two ways; the first does not include money and the second uses money such that the firm and/or the household have an endowment that can be spent or saved. In either case, the household has preferences for leisure and consumption and a demand function relating sugar and price, and the firm has a production function and learns the household demand over a set number of time steps using either an endogenous or exogenous learning algorithm. The resulting equilibria, or fixed points of the system, may or may not match the classical economic equilibrium.

LAMDA - Learning Agents for Mechanism-Design Analysis

Iris Lorscheid Matthias Meyer | Published Monday, August 08, 2016The simulation model LAMDA investigates the influences of varying cognitive abilities of the decision maker on the truth-inducing effect of the Groves mechanism. Bounded rationality concepts are represented by information states and learning models.

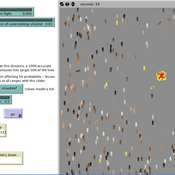

Active Shooter: An Agent-Based Model of Unarmed Resistance

William Kennedy Tom Briggs | Published Thursday, December 29, 2016 | Last modified Tuesday, April 04, 2017A NetLogo ABM developed to explore unarmed resistance to an active shooter. The landscape is a generalized open outdoor area. Parameters enable the user to set shooter armament and control for assumptions with regard to shooter accuracy.

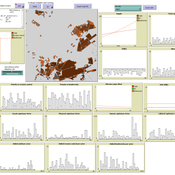

RecovUS: An Agent-Based Model of Post-Disaster Household Recovery

Saeed Moradi | Published Thursday, July 30, 2020The purpose of this model is to explain the post-disaster recovery of households residing in their own single-family homes and to predict households’ recovery decisions from drivers of recovery. Herein, a household’s recovery decision is repair/reconstruction of its damaged house to the pre-disaster condition, waiting without repair/reconstruction, or selling the house (and relocating). Recovery drivers include financial conditions and functionality of the community that is most important to a household. Financial conditions are evaluated by two categories of variables: costs and resources. Costs include repair/reconstruction costs and rent of another property when the primary house is uninhabitable. Resources comprise the money required to cover the costs of repair/reconstruction and to pay the rent (if required). The repair/reconstruction resources include settlement from the National Flood Insurance (NFI), Housing Assistance provided by the Federal Emergency Management Agency (FEMA-HA), disaster loan offered by the Small Business Administration (SBA loan), a share of household liquid assets, and Community Development Block Grant Disaster Recovery (CDBG-DR) fund provided by the Department of Housing and Urban Development (HUD). Further, household income determines the amount of rent that it can afford. Community conditions are assessed for each household based on the restoration of specific anchors. ASNA indexes (Nejat, Moradi, & Ghosh 2019) are used to identify the category of community anchors that is important to a recovery decision of each household. Accordingly, households are indexed into three classes for each of which recovery of infrastructure, neighbors, or community assets matters most. Further, among similar anchors, those anchors are important to a household that are located in its perceived neighborhood area (Moradi, Nejat, Hu, & Ghosh 2020).

Bargaining with misvaluation

Marcin Czupryna | Published Wednesday, January 14, 2026Subjective biases and errors systematically affect market equilibria, whether at the population level or in bilateral trading. Here, we consider the possibility that an agent engaged in bilateral trading is mistaken about her own valuation of the good she expects to trade, that has not been explicitly incorporated into the existing bilateral trade literature. Although it may sound paradoxical that a subjective private valuation is something an agent can be mistaken about, as it is up to her to fix it, we consider the case in which that agent, seller or buyer, consciously or not, given the structure of a market, a type of good, and a temporary lack of information, may arrive at an erroneous valuation. The typical context through which this possibility may arise is in relation with so-called experience goods, which are sold while all their intrinsic qualities are still unknown (such as untasted bottled fine wines). We model this “private misvaluation” phenomenon in our study. The agents may also be mistaken about how their exchange counterparties are themselves mistaken. Formally, they attribute a certain margin of error to the other agent, which can differ from the actual way that another agent misvalues the good under consideration. This can constitute the source of a second-order misvaluation. We model different attitudes and situations in which agents face unexpected signals from their counterparties and the manner and extent to which they revise their initial beliefs. We analyse and simulate numerically the consequences of first-order and second-order misvaluation on market equilibria.

The Effects of Fiscal Targets in a Currency Union: a Multi-Country Agent Based-Stock Flow Consistent Model

Ermanno Catullo Alessandro Caiani Mauro Gallegati | Published Saturday, March 11, 2017We present an Agent-Based Stock Flow Consistent Multi-Country model of a Currency Union to analyze the impact of changes in the fiscal regimes that is permanent changes in the deficit-to-GDP targets that governments commit to comply.

Can ethnic tolerance curb self-reinforcing school segregation? A theoretical Agent Based Model

Lucas Sage Andreas Flache | Published Monday, August 10, 2020Schelling and Sakoda prominently proposed computational models suggesting that strong ethnic residential segregation can be the unintended outcome of a self-reinforcing dynamic driven by choices of individuals with rather tolerant ethnic preferences. There are only few attempts to apply this view to school choice, another important arena in which ethnic segregation occurs. In the current paper, we explore with an agent-based theoretical model similar to those proposed for residential segregation, how ethnic tolerance among parents can affect the level of school segregation. More specifically, we ask whether and under which conditions school segregation could be reduced if more parents hold tolerant ethnic preferences. We move beyond earlier models of school segregation in three ways. First, we model individual school choices using a random utility discrete choice approach. Second, we vary the pattern of ethnic segregation in the residential context of school choices systematically, comparing residential maps in which segregation is unrelated to parents’ level of tolerance to residential maps reflecting their ethnic preferences. Third, we introduce heterogeneity in tolerance levels among parents belonging to the same group. Our simulation experiments suggest that ethnic school segregation can be a very robust phenomenon, occurring even when about half of the population prefers mixed to segregated schools. However, we also identify a “sweet spot” in the parameter space in which a larger proportion of tolerant parents makes the biggest difference. This is the case when parents have moderate preferences for nearby schools and there is only little residential segregation. Further experiments are presented that unravel the underlying mechanisms.

Peer reviewed The Viability of the Social-Ecological Agroecosystem (ViSA) Spatial Agent-based Model

Mostafa Shaaban | Published Monday, March 25, 2024ViSA 2.0.0 is an updated version of ViSA 1.0.0 aiming at integrating empirical data of a new use case that is much smaller than in the first version to include field scale analysis. Further, the code of the model is simplified to make the model easier and faster. Some features from the previous version have been removed.

It simulates decision behaviors of different stakeholders showing demands for ecosystem services (ESS) in agricultural landscape. It investigates conditions and scenarios that can increase the supply of ecosystem services while keeping the viability of the social system by suggesting different mixes of initial unit utilities and decision rules.

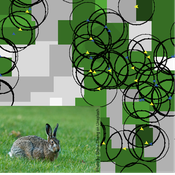

Mitigating bioenergy-driven biodiversity decline: a modelling approach with the European brown hare

Volker Grimm Maria Langhammer | Published Wednesday, November 13, 2019 | Last modified Tuesday, November 24, 2020The model is designed to analyse the effects of mitigation measures on the European brown hare (Lepus europaeus), which is directly affected by ongoing land use change and has experienced widespread decline throughout Europe since the 1960s. As an input, we use two 4×4 km large model landscapes, which were generated by a landscape generator based on real field sizes and crop proportions and differed in average field size and crop composition. The crops grown annually are evaluated in terms of forage suitability, breeding suitability and crop richness for the hare. Six mitigation scenarios are implemented, defined by a 10 % increase in: (1) mixed silphie, (2) miscanthus, (3) grass-clover ley, (4) alfalfa, (5) set-aside, and (6) general crop richness. The model shows that that both landscape configuration and composition have a significant effect on hare population development, which responds particularly strongly to compositional changes.

Simulating the cost of social care in an ageing population

Eric Silverman | Published Thursday, September 16, 2021This model is an agent-based simulation written in Python 2.7, which simulates the cost of social care in an ageing UK population. The simulation incorporates processes of population change which affect the demand for and supply of social care, including health status, partnership formation, fertility and mortality. Fertility and mortality rates are drawn from UK population data, then projected forward to 2050 using the methods developed by Lee and Carter 1992.

The model demonstrates that rising life expectancy combined with lower birthrates leads to growing social care costs across the population. More surprisingly, the model shows that the oft-proposed intervention of raising the retirement age has limited utility; some reductions in costs are attained initially, but these reductions taper off beyond age 70. Subsequent work has enhanced and extended this model by adding more detail to agent behaviours and familial relationships.

The version of the model provided here produces outputs in a format compatible with the GEM-SA uncertainty quantification software by Kennedy and O’Hagan. This allows sensitivity analyses to be performed using Gaussian Process Emulation.

Displaying 10 of 334 results for "Chelsea E Hunter" clear search